Every roofing professional has experienced the sinking realization: the “bargain” materials that promised savings have just doubled your labor costs. The crew is wrestling with inconsistent shingles, callbacks are piling up, and your profit margin has evaporated. Meanwhile, you watch competitors somehow secure quality materials without breaking the bank, and the pricing game feels rigged.

This frustration stems from a fundamental misconception about the roofing supplies market. The industry has conditioned contractors to believe in a simple equation: cheap materials cost more long-term, so buy premium products. But this binary thinking ignores the sophisticated pricing mechanisms and procurement strategies that separate sustainable businesses from struggling ones.

The real challenge isn’t choosing between budget and premium. It’s understanding the hidden cost multipliers that make low-quality materials exponentially expensive, while simultaneously recognizing that high prices don’t guarantee superior performance. Between these extremes lies a systematic approach to procurement that transforms material sourcing from a recurring liability into a competitive advantage.

This framework moves beyond vague warnings about quality to expose specific economic mechanisms, pricing illusions, and strategic timing windows. The goal is building a repeatable system that guarantees optimal value on every purchase, eliminating the cycle of costly mistakes that drain both capital and credibility.

Smart Roofing Material Sourcing: The 5 Essential Strategies

- Budget materials create cost multiplication through labor inefficiency, callbacks, and warranty exposure that transforms 20% savings into 200% losses

- Premium pricing exploits distributor margin structures and brand markups disconnected from actual manufacturing quality differences

- Field-verifiable testing protocols and supplier transparency signals provide reliable quality prediction before volume commitment

- Seasonal inventory cycles and fiscal pressure points create 15-30% pricing advantages without sacrificing material performance

- Systematic supplier scorecards with performance KPIs prevent regression to costly purchasing patterns

Hidden Cost Multipliers of Budget Roofing Material Decisions

The advertised price per square foot reveals almost nothing about actual material cost. Budget roofing products trigger a cascade of secondary expenses that multiply the initial savings into substantial losses. Understanding these multiplier mechanisms transforms vague industry warnings into quantifiable business decisions.

Labor inefficiency represents the most immediate multiplier. When installers work with materials that have inconsistent dimensions, unpredictable flexibility, or unclear installation indicators, every task takes longer. A crew that normally completes a standard residential roof in two days suddenly needs three. The material costs account for 40-50% of total replacement expenses, but when installation time increases by 30-50%, labor costs can eclipse any material savings within a single job.

Callback economics create even more severe damage. When a roofing system fails prematurely, the cost isn’t simply replacing defective materials. It includes mobilizing the crew again, managing customer dissatisfaction, and absorbing the complete loss of profit from the original job. Industry data consistently shows budget materials generating callback rates of 25-35% compared to 5-10% for quality products, transforming occasional issues into systematic profit erosion.

2024 Insurance Impact Analysis on Roofing Claims

State Farm reported paying over $3.8 billion in home repairs for hail damage claims in 2024. Triple-I data showed hail damage costing homes approximately $160 billion in reconstruction cost value across the U.S. This massive claim volume disproportionately affected properties with lower-grade roofing materials that failed to meet impact resistance standards, creating premium increases and warranty disputes that extended far beyond the immediate repair costs.

Crew productivity drag operates more subtly but compounds over time. When teams know they’re installing inferior materials, morale suffers. Installers become frustrated handling products that tear unexpectedly, don’t seal properly, or require workarounds. This psychological drag reduces efficiency across all jobs, not just the ones using budget materials, creating a culture of mediocrity that’s difficult to reverse.

| Cost Factor | Budget Materials | Quality Materials |

|---|---|---|

| Installation Time | +30% longer | Standard |

| Callback Rate | 25-35% | 5-10% |

| Warranty Coverage | 10-15 years | 25-50 years |

| Energy Efficiency Loss | Up to 22% higher | Baseline |

Insurance and warranty exposure represents the final multiplier. Budget materials increase claim frequency, raising premiums over time. When warranties fail to cover common failure modes due to fine print exclusions, contractors absorb costs they assumed were protected. This long-tail risk doesn’t appear on any invoice but systematically undermines business sustainability.

Scheduling a roof replacement in late fall or winter can save you on costs, as prices typically decrease during these seasons

– Rapid Roofing Research Team, Rapid Roofing Market Analysis

These multipliers don’t operate independently. They compound. A 20% material savings that increases installation time by 30%, generates a 30% callback rate, and creates warranty exposure can easily produce total costs exceeding 200% of the original “savings.” The math isn’t subtle once you track actual job profitability rather than invoice prices.

The Premium Pricing Illusion in Roofing Supply Markets

Recognizing that budget materials multiply costs creates a dangerous overcorrection: assuming expensive products guarantee quality. This trap proves equally costly, as roofing supply pricing structures deliberately obscure the relationship between cost and performance. Distributor margin layering, brand premium disconnects, and regional pricing monopolies create price points that reflect market power rather than material value.

Supplier and distributor margins create the first layer of inflation. A manufacturer might produce a shingle for $12 per bundle, sell it to a regional distributor for $18, who then sells to a local supplier for $24, who finally offers it to contractors at $32. Each intermediary adds 30-40% margin. The overall U.S. residential construction costs rose by roughly 4-5% year-over-year in 2024, but these increases often triggered disproportionate pricing adjustments as each distribution layer applied percentage markups to already-inflated base costs.

Brand premium mechanics operate independently from manufacturing quality. Two products from the same factory, with identical specifications and performance characteristics, can carry 40-60% price differences based purely on branding. The “contractor grade” and “professional series” labels often signify nothing more than packaging and marketing positioning, with minimal or nonexistent manufacturing differentiation.

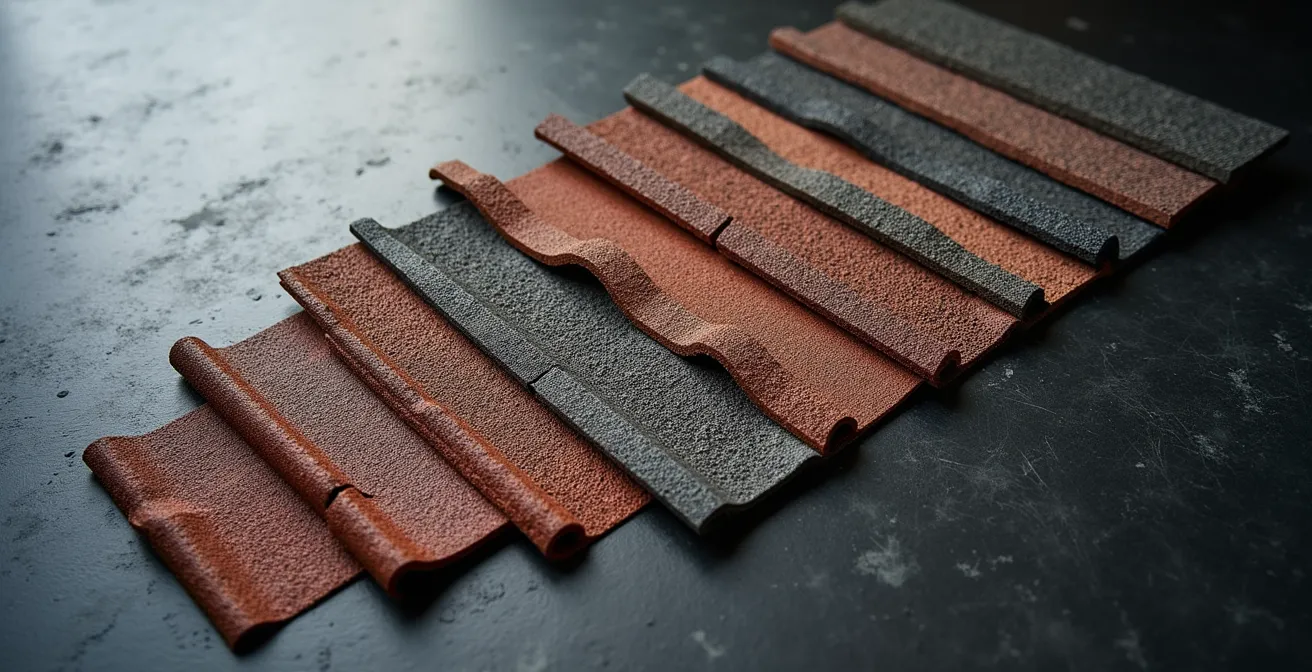

Visual inspection reveals what pricing obscures. When examining materials at the granule level, true quality differences become apparent through texture density, granule embedment depth, and substrate consistency. These physical characteristics correlate with performance far more reliably than price tags, yet most purchasing decisions happen at the invoice level rather than the material level.

Regional distributor dynamics further distort pricing. In markets dominated by one or two major suppliers, artificial price floors emerge that have no relationship to actual costs or value. These oligopolies create situations where contractors in adjacent states pay 25-35% different prices for identical products, purely based on competitive intensity in their local market.

| Material Type | Cost per Sq Ft | Lifespan |

|---|---|---|

| Asphalt Shingles | $4-$15 | 20-30 years |

| Metal Roofing | $8-$20 | 40-50 years |

| Slate | $15-$30 | 75-100 years |

Direct manufacturer sourcing models offer an alternative to traditional distribution chains, but they come with their own complexities. Minimum order volumes, extended lead times, and reduced flexibility can offset price advantages unless procurement is planned systematically. The key insight is that distribution channel choice matters as much as product selection.

Identifying true value in roofing materials

- Request manufacturer specification sheets, not distributor marketing materials

- Compare warranty terms line-by-line, focusing on exclusions and labor coverage

- Verify actual manufacturing location and batch consistency data

- Calculate total installed cost per year of expected life, not upfront price

The pricing illusion succeeds because it exploits information asymmetry. Suppliers know their cost structures and margin opportunities; contractors typically don’t. Closing this knowledge gap transforms negotiating position from reactive to strategic, enabling value capture that doesn’t sacrifice quality.

Performance Indicators That Reliably Predict Material Longevity

With price eliminated as a reliable quality indicator, contractors need verifiable assessment methods. Passive certification checking provides a baseline, but active testing protocols and transparency signals offer far more predictive power. These methods shift control from trusting supplier claims to independent verification before volume commitment.

Field-executable physical tests require minimal equipment but deliver substantial insight. A simple flexibility check reveals substrate quality: bend a shingle sample 180 degrees in moderate temperature conditions. Quality materials flex smoothly without cracking; inferior products develop stress fractures or surface damage. Tear strength assessment works similarly—attempt to tear a small sample from the edge. Products that resist tearing with consistent force demonstrate superior fiber bonding and material integrity.

Impact resistance standards provide critical performance thresholds, particularly in severe weather markets. The materials rated Class 4 for impact resistance can withstand hail up to 2 inches in diameter, a specification that dramatically reduces insurance claims and warranty callbacks in hail-prone regions. This rating comes from standardized UL 2218 testing, but contractors can perform informal verification by dropping a steel ball from specified heights onto samples.

Manufacturing batch consistency represents a more sophisticated quality indicator. Request samples from multiple production batches and compare color consistency, granule adhesion, and dimensional accuracy. Suppliers with rigorous quality control deliver remarkably consistent products across batches; those with looser standards show noticeable variation. This variance directly predicts field performance and installation efficiency.

Tactile evaluation by experienced installers captures nuances that specifications miss. The way material feels during handling, how it responds to cutting and fastening, and subtle variations in weight distribution all signal manufacturing quality. Building this assessment into material selection leverages hard-won field expertise, transforming installation experience into procurement advantage.

| Test Condition | Standard Materials | High-Performance Materials |

|---|---|---|

| Wind Uplift Resistance | 90-110 mph | 130-160 mph |

| Temperature Cycling | 15-20 years | 30-50 years |

| UV Degradation Rate | 5% annually | 1-2% annually |

Third-party testing lab certifications vary dramatically in rigor and meaning. ASTM standards provide baseline requirements, but they represent minimum thresholds rather than excellence indicators. More valuable are independent testing reports that show performance margins above minimum standards. A product that exceeds ASTM D3462 tear strength requirements by 40% demonstrates superior manufacturing compared to one that barely meets the threshold.

A well-defined nail zone simplifies installation, making it easier to achieve a high-quality roof

– Roofing Insights Testing Team, 2024 Shingle Guide

Supplier transparency signals offer predictive value beyond specific product tests. Companies that readily provide complete specification sheets, disclose manufacturing origins, and offer detailed warranty structures typically deliver consistent quality. Those that rely on marketing language, resist sharing technical data, or provide vague warranty terms often signal quality control issues. This transparency assessment costs nothing but reliably filters suppliers before any material purchase.

Strategic Procurement Timing for Quality Without Overpayment

Quality verification establishes what to buy; strategic timing determines what you’ll pay. Roofing supply markets operate on predictable cycles driven by seasonal demand, inventory pressures, and fiscal calendars. Understanding these patterns creates negotiation leverage that secures 15-30% pricing advantages without compromising specifications.

Seasonal inventory cycles create the most accessible leverage points. Suppliers face significant carrying costs for roofing materials, particularly heading into winter months when demand plummets. October through December represents peak negotiating power as distributors prioritize cash flow over margin. The inverse occurs in March and April when suppliers anticipate seasonal demand increases and implement price adjustments. The material price increases of up to 6% on all residential roofing materials in April 2024 followed a predictable pre-season pattern that strategic buyers anticipated and avoided through earlier purchasing.

Quarter-end and fiscal calendar dynamics operate independently from seasonal patterns. Most distributors and manufacturers carry monthly, quarterly, and annual sales targets that create predictable pressure points. The final week of each quarter, particularly Q4, generates motivation to close deals that might otherwise extend into the next period. This urgency isn’t about the products—it’s about reporting metrics and compensation structures.

Warehouse optimization principles resemble challenges in other logistics-intensive industries. The systematic organization and inventory timing strategies that define efficient operations extend beyond roofing to any business managing physical goods movement. This operational discipline around procurement timing and supplier coordination creates competitive advantages regardless of industry context.

| Period | Market Condition | Strategy |

|---|---|---|

| Q4 (Oct-Dec) | Low demand season | Negotiate volume deals |

| Q1 (Jan-Mar) | Pre-season inventory | Lock pricing before April increases |

| Q2 (Apr-Jun) | Peak pricing period | Avoid unless urgent |

Volume commitment strategies unlock pricing tiers without dangerous lock-in. Rather than committing to specific delivery dates or products, structure agreements around aggregate annual volume with quarterly ordering windows. This provides suppliers the forecasting visibility they value while preserving flexibility to adjust product mix based on actual project demands.

Commercial Roofing Market Dynamics 2024

68% of contractors expect to close 2024 with sales volumes improving over last year. 80% of respondents are saying they expect 2025 annual sales revenues to slightly or greatly increase. This optimism created competitive pressure among suppliers to secure contractor relationships, generating unusually aggressive pricing and terms offers during late 2024 that strategic buyers leveraged for long-term agreements with favorable annual adjustments.

Dual-sourcing relationship strategies create ongoing competitive pressure without sacrificing reliability. Maintain qualified relationships with 3-4 suppliers for critical materials, placing orders strategically to keep multiple channels active. This prevents dependency on any single source while providing leverage during negotiations, as suppliers recognize they’re competing for share rather than holding monopoly position.

Volume commitment negotiation framework

- Analyze regional labor cost variations (California rates 2x Midwest)

- Identify manufacturer preferred contractor programs for bulk discounts

- Structure phased purchase agreements to maintain flexibility

- Leverage end-of-quarter fiscal pressure points for better terms

The temporal dimension of procurement remains the most underutilized advantage in roofing supply purchasing. While competitors react to immediate project needs, strategic buyers anticipate cycles and position purchases to capture optimal value consistently.

Key Takeaways

- Budget materials trigger cost multipliers through labor inefficiency and callbacks that transform small savings into substantial losses

- Premium pricing reflects distribution margins and brand positioning rather than manufacturing quality differences

- Field-verifiable testing protocols and supplier transparency signals predict performance more reliably than certifications or price

- Seasonal cycles and fiscal calendar pressure points create 15-30% negotiation advantages on quality materials

- Systematic supplier performance tracking prevents regression to costly purchasing patterns over time

Supplier Scorecard Systems That Eliminate Future Purchasing Errors

Strategic procurement delivers one-time gains; systematic tracking converts them into permanent advantages. Without structured supplier evaluation, the natural drift toward convenience and habit gradually erodes gains from optimized purchasing. Implementing a simple scorecard framework with quarterly reviews prevents this regression while continuously improving supplier performance.

Core performance KPIs must be objective, measurable, and consistently tracked. Material quality variance by batch provides the foundation—track defect rates, consistency issues, and performance failures across every delivery. Delivery reliability extends beyond on-time percentage to include order accuracy, damage rates during transit, and responsiveness to urgent requests. Price stability matters as much as absolute pricing; suppliers who frequently adjust prices or impose unexpected fees create planning difficulties that offset nominal cost advantages.

| KPI Category | Metric | Target |

|---|---|---|

| Quality Consistency | Batch variance rate | <3% |

| Delivery Reliability | On-time delivery % | >95% |

| Price Stability | Quarterly price variance | <5% |

| Support Response | Issue resolution time | <24 hours |

Job-level material performance documentation builds the evidence database that makes supplier evaluation credible. After each project, capture specific material performance notes: installation efficiency observations, any quality issues encountered, and comparative assessment against previous suppliers. This granular tracking transforms vague impressions into quantifiable patterns that justify supplier decisions.

Quarterly supplier review protocols formalize the evaluation process. Schedule brief meetings with key suppliers to discuss scorecard results, address performance issues, and explore improvement opportunities. These conversations signal that your business tracks performance systematically, elevating service levels and creating accountability that informal relationships rarely achieve. Applying proven customer experience tips when structuring these reviews ensures supplier responsiveness improves continuously rather than episodically.

Supplier switching decision frameworks prevent both premature changes and prolonged tolerance of poor performance. Establish clear thresholds: consistent failure to meet targets in two or more KPI categories over two consecutive quarters triggers formal supplier review. Minor issues get documented and addressed; systemic problems initiate transition planning. This structured approach avoids reactive decisions while preventing complacency.

By leveraging the latest tools and technologies, they can deliver superior results, boost productivity, and carve a distinctive edge

– Preferred Roofing Supply, Innovations in Roofing Tools 2024

The scorecard system succeeds not through complexity but through consistency. Simple metrics tracked reliably outperform sophisticated frameworks applied sporadically. The goal is creating accountability and continuous improvement, transforming supplier relationships from transactional interactions into strategic partnerships that deliver compounding value over time.

This systematic approach to roofing material procurement closes the loop from identifying hidden costs and pricing illusions through verification methods and strategic timing to ongoing performance optimization. The framework doesn’t require sophisticated software or extensive resources—just disciplined implementation of proven procurement principles adapted to roofing supply market dynamics. The result is predictable access to quality materials at optimal prices, eliminating the frustration and financial drain of repeated purchasing mistakes.

Frequently Asked Questions About Roofing Supplies

What’s the minimum number of suppliers to maintain for redundancy?

Industry best practice suggests maintaining relationships with 3-4 qualified suppliers for critical materials. This provides sufficient backup options without creating excessive administrative burden from managing too many vendor relationships.

How do financing options from suppliers impact total cost?

Many reputable roofing suppliers provide financing options that can reduce immediate cash outlay by 30-40%. However, carefully evaluate interest rates and terms, as financing costs can offset material savings if not structured properly.

How long should quality roofing materials typically last?

Quality asphalt shingles generally last 20-30 years, metal roofing 40-50 years, and premium materials like slate 75-100 years. Actual lifespan depends heavily on installation quality, climate conditions, and maintenance practices beyond just material specifications.

When is the best time to negotiate bulk material pricing?

October through December offers optimal negotiating leverage as suppliers face low seasonal demand and year-end inventory pressures. Additionally, the final week of any fiscal quarter creates urgency that can generate favorable pricing regardless of season.